Marshall Islands' plan for a national cryptocurrency survives crucial vote

Plans to launch a national cryptocurrency for the Republic of the Marshall Islands are still in motion after President Hilda Heine survived a vote of no confidence.

The Pacific Island nation intends to issue a local cryptocurrency called the sovereign (SOV) as a second legal tender, alongside the US dollar, despite concerns being raised about the economic risks involved with such an endeavour.

President Heine faced a vote of no confidence after eight senators accused her of damaging the reputation of the country by backing of the proposed currency.

However, she survived by a single vote.

Finance Minister Brenson Wase said the Marshallese government would now move forward with plans for the sovereign cryptocurrency, according to the Nikkei Asian Review.

The government hopes to raise funds by selling half of the cryptocurrency’s initial allocation to foreign investors. The remainder will either be kept in a governmental trust fund or distributed to citizens of the Marshall Islands.

A date for the initial coin offering (ICO) is yet to be announced but minister-in-assistance to the president David Paul said in February that its legal tender status has already been approved by the country’s parliament.

“This creates legal certainty for its use, because all jurisdictions have laws in place for dealing with legal tender, whereas private cryptocurrencies are dealt with differently in different jurisdictions,” a government statement said at the time.

1/8 Satoshi Nakamoto creates the first bitcoin block in 2009

On 3 January, 2009, the genesis block of bitcoin appeared. It came less than a year after the pseudonymous creator Satoshi Nakamoto detailed the cryptocurrency in a paper titled ‘Bitcoin: A peer-to-Peer Electronic Cash System’

Reuters

2/8 Bitcoin is used as a currency for the first time

On 22 May, 2010, the first ever real-world bitcoin transaction took place. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $90 million at today’s prices

Lazlo Hanyecz

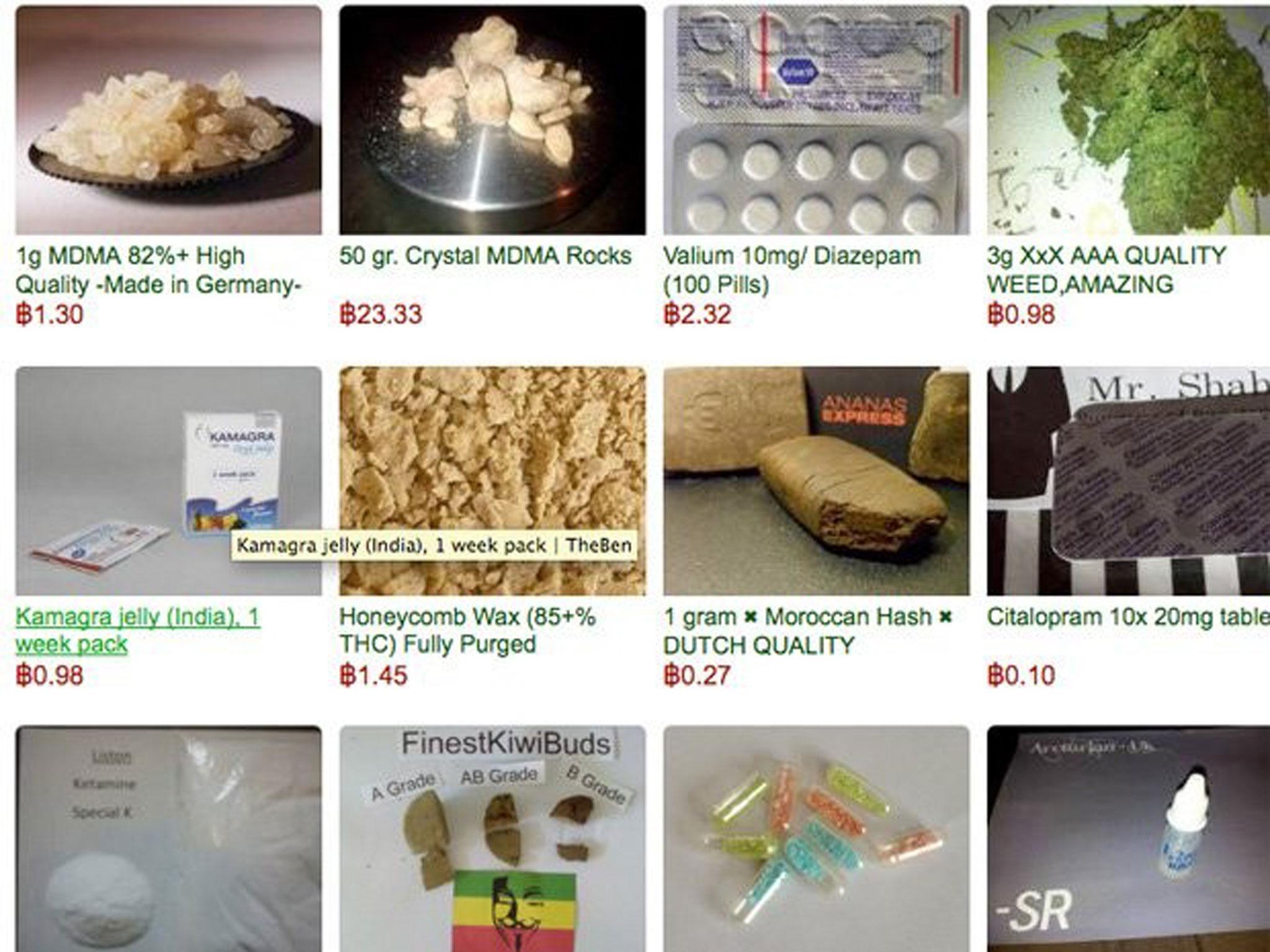

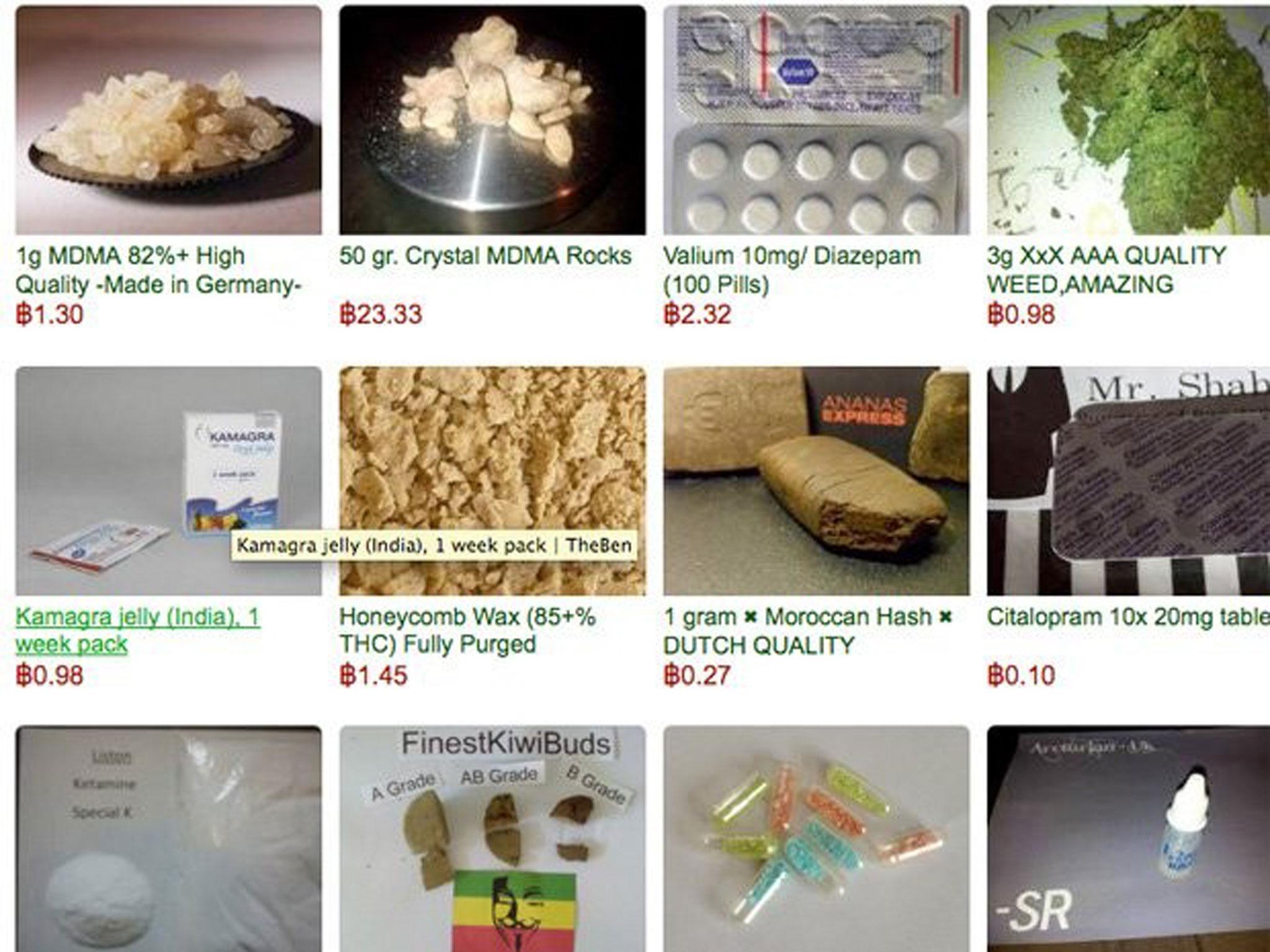

3/8 Silk Road opens for business

Bitcoin soon gained notoriety for its use on the dark web. The Silk Road marketplace, established in 2011, was the first of hundreds of sites to offer illegal drugs and services in exchange for bitcoin

4/8 The first bitcoin ATM appears

On 29 October, 2013, the first ever bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins for cash

REUTERS/Dimitris Michalakis

5/8 The fall of MtGox

The world’s biggest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing almost 750,000 of its customers bitcoins. At the time, this was around 7 per cent of all bitcoins and the market inevitably crashed

Getty Images

6/8 Would the real Satoshi Nakamoto please stand up

In 2015, Australian police raided the home of Craig Wright after the entrepreneur claimed he was Satoshi Nakamoto. He later rescinded the claim

Getty Images

7/8 Bitcoin’s big split

On 1 August, 2017, an unresolvable dispute within the bitcoin community saw the network split. The fork of bitcoin’s underlying blockchain technology spawned a new cryptocurrency: Bitcoin cash

REUTERS

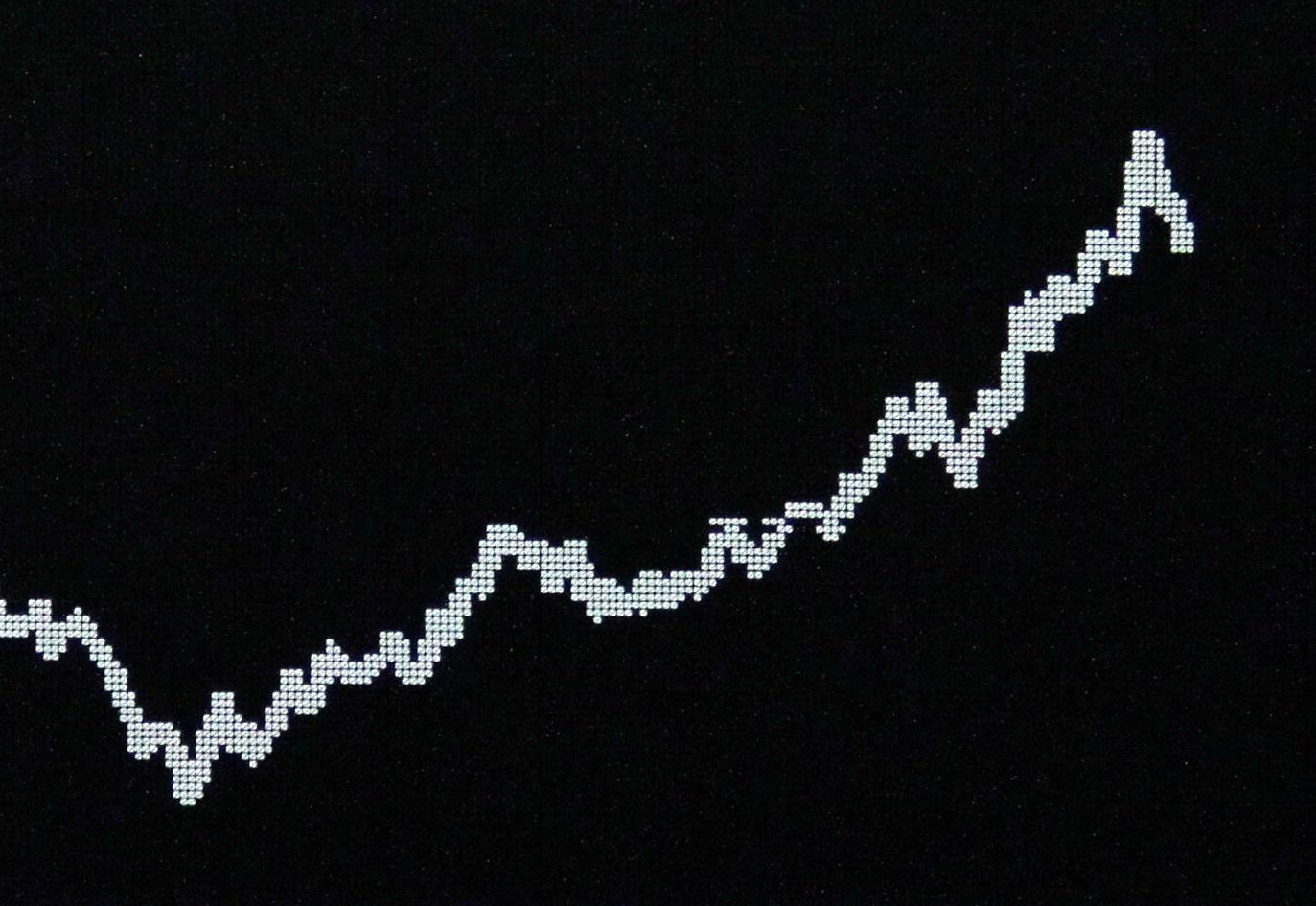

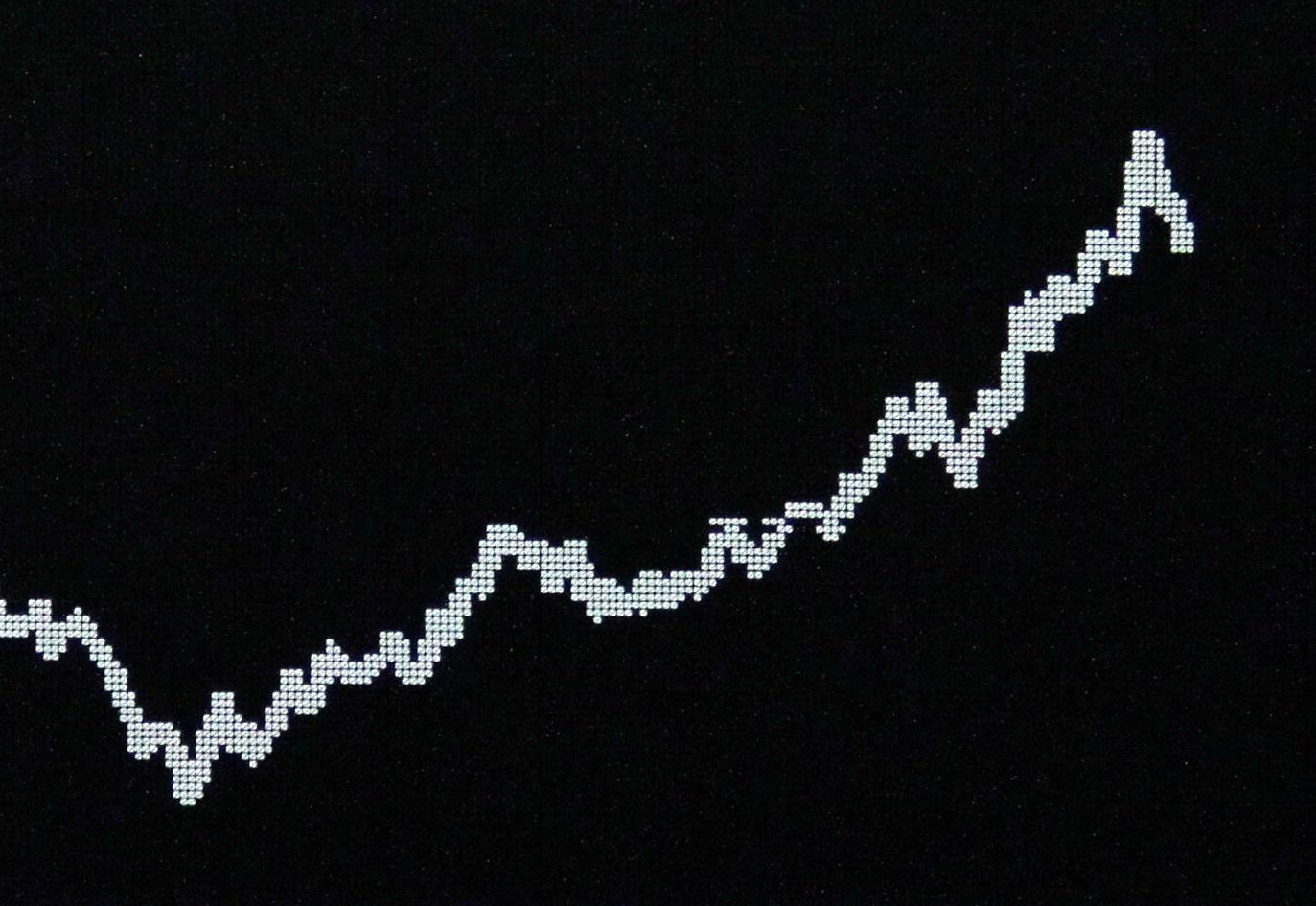

8/8 Bitcoin’s price sky rockets

Towards the end of 2017, the price of bitcoin surged to almost $20,000. This represented a 1,300 per cent increase from its price at the start of the year

Reuters

1/8 Satoshi Nakamoto creates the first bitcoin block in 2009

On 3 January, 2009, the genesis block of bitcoin appeared. It came less than a year after the pseudonymous creator Satoshi Nakamoto detailed the cryptocurrency in a paper titled ‘Bitcoin: A peer-to-Peer Electronic Cash System’

Reuters

2/8 Bitcoin is used as a currency for the first time

On 22 May, 2010, the first ever real-world bitcoin transaction took place. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $90 million at today’s prices

Lazlo Hanyecz

3/8 Silk Road opens for business

Bitcoin soon gained notoriety for its use on the dark web. The Silk Road marketplace, established in 2011, was the first of hundreds of sites to offer illegal drugs and services in exchange for bitcoin

4/8 The first bitcoin ATM appears

On 29 October, 2013, the first ever bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins for cash

REUTERS/Dimitris Michalakis

5/8 The fall of MtGox

The world’s biggest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing almost 750,000 of its customers bitcoins. At the time, this was around 7 per cent of all bitcoins and the market inevitably crashed

Getty Images

6/8 Would the real Satoshi Nakamoto please stand up

In 2015, Australian police raided the home of Craig Wright after the entrepreneur claimed he was Satoshi Nakamoto. He later rescinded the claim

Getty Images

7/8 Bitcoin’s big split

On 1 August, 2017, an unresolvable dispute within the bitcoin community saw the network split. The fork of bitcoin’s underlying blockchain technology spawned a new cryptocurrency: Bitcoin cash

REUTERS

8/8 Bitcoin’s price sky rockets

Towards the end of 2017, the price of bitcoin surged to almost $20,000. This represented a 1,300 per cent increase from its price at the start of the year

Reuters

A September report from the International Monetary Fund (IMF) warned that the new cryptocurrency still faced several challenges.

“The Marshallese authorities are well aware that issuing a legal tender cryptocurrency puts RMI into uncharted waters, and that there are many risks involved in issuing the SOV,” the report stated. “However, they believe they can work through these issues. They have created a high-ranking committee to examine all the risks, including those raised by the IMF and the US Treasury, and those discussed during the public hearings on the legislation.”

The issues laid out by the IMF include reputational risks and a danger of losing its correspondent banking relationship (CBR) with the US dollar.

“Given these sorts of issues, the authorities expect it will take a few years to issue the cryptocurrency,” the IMF report concluded.

“Moreover, they will only issue the SOV once its use complies with the FATF (Financial Action Task Force) standard and US regulation, and once its use in transactions in the US financial system has been approved by the US government.”

Original Source