Countries come together in hope of creating cryptocurrency backed by central banks

The Bank of England has created an international group to explore the possibility of developing a cryptocurrency backed by central banks.

The central banks of Japan, Sweden, Switzerland and the eurozone joined the initiative, together with the Bank of International Settlements (BIS).

The group will look at the economic and technical benefits that a bitcoin-style digital currency could offer.

Global focus on central bank digital currencies (CBDC) intensified last year after Facebook announced plans to introduce a cryptocurrency called Libra.

The European Central Bank subsequently expressed an interest in creating its own digital currency, while China has also moved forward with plans to launch a state-backed cryptocurrency.

“The group will assess CBDC use cases; economic, functional and technical design choices, including cross-border interoperability; and the sharing of knowledge on emerging technologies,” the banks said in a joint statement on Tuesday.

1/8 Satoshi Nakamoto creates the first bitcoin block in 2009

On 3 January, 2009, the genesis block of bitcoin appeared. It came less than a year after the pseudonymous creator Satoshi Nakamoto detailed the cryptocurrency in a paper titled ‘Bitcoin: A peer-to-Peer Electronic Cash System’

Reuters

2/8 Bitcoin is used as a currency for the first time

On 22 May, 2010, the first ever real-world bitcoin transaction took place. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $90 million at today’s prices

Lazlo Hanyecz

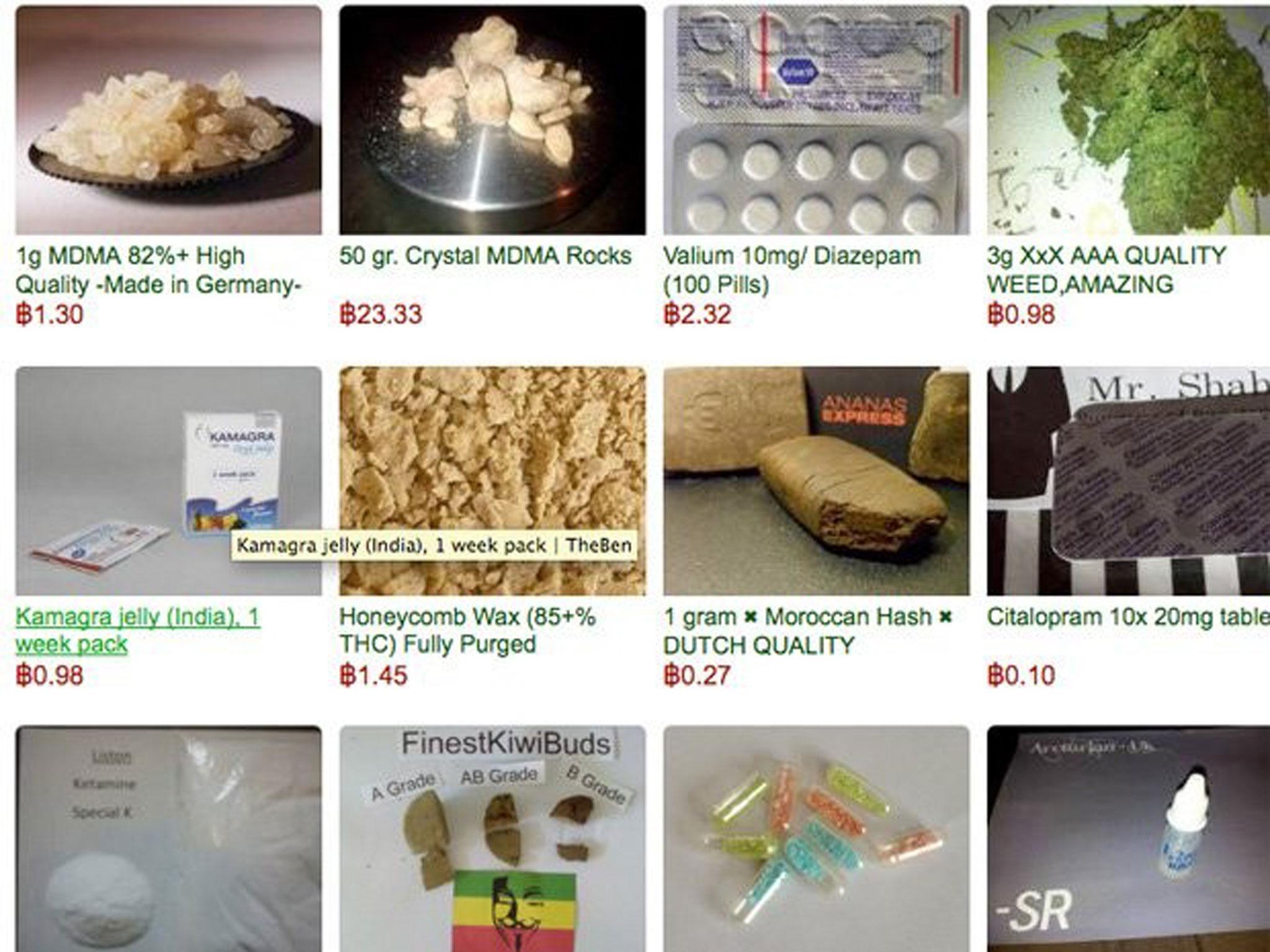

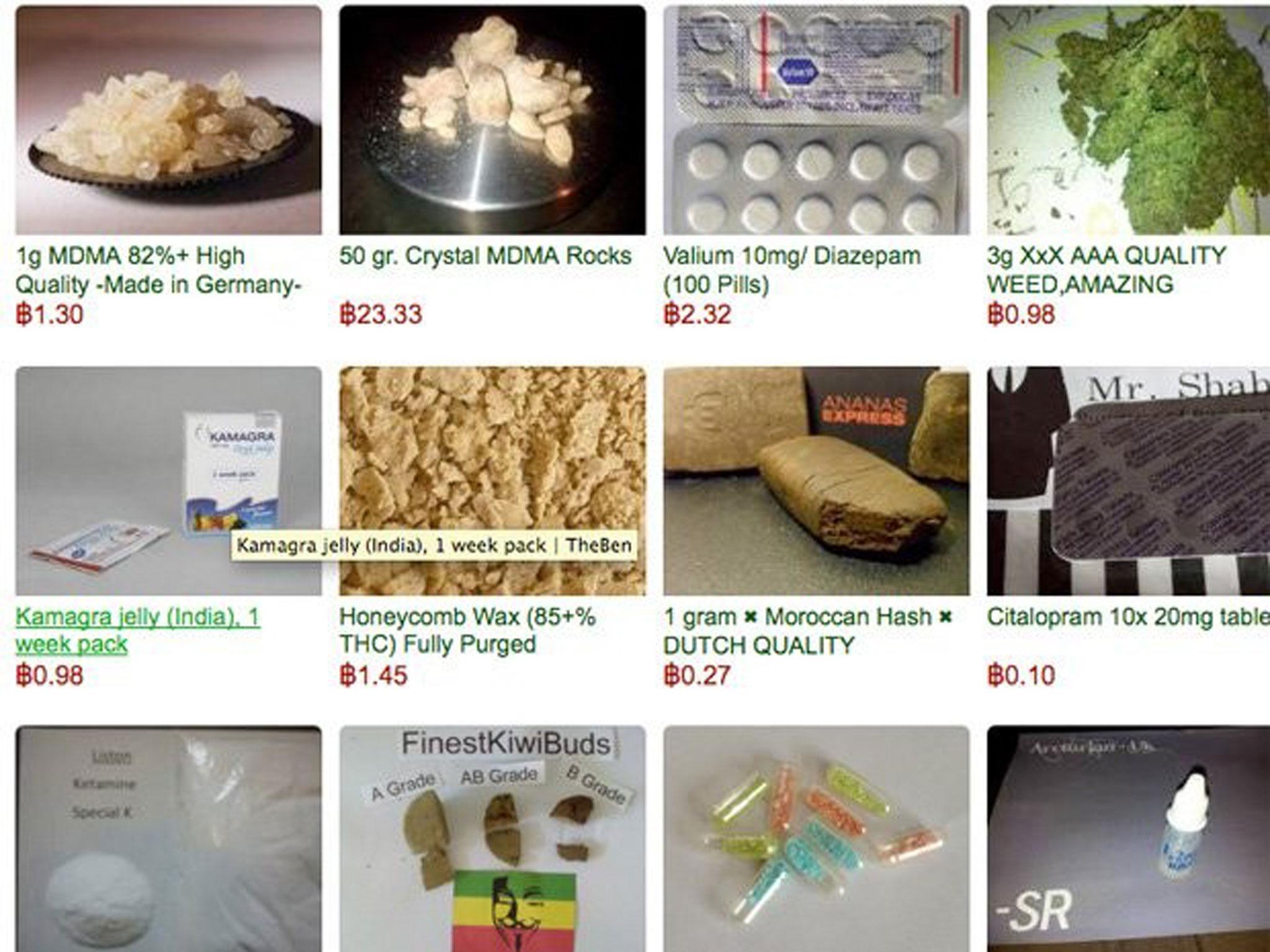

3/8 Silk Road opens for business

Bitcoin soon gained notoriety for its use on the dark web. The Silk Road marketplace, established in 2011, was the first of hundreds of sites to offer illegal drugs and services in exchange for bitcoin

4/8 The first bitcoin ATM appears

On 29 October, 2013, the first ever bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins for cash

REUTERS/Dimitris Michalakis

5/8 The fall of MtGox

The world’s biggest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing almost 750,000 of its customers bitcoins. At the time, this was around 7 per cent of all bitcoins and the market inevitably crashed

Getty Images

6/8 Would the real Satoshi Nakamoto please stand up

In 2015, Australian police raided the home of Craig Wright after the entrepreneur claimed he was Satoshi Nakamoto. He later rescinded the claim

Getty Images

7/8 Bitcoin’s big split

On 1 August, 2017, an unresolvable dispute within the bitcoin community saw the network split. The fork of bitcoin’s underlying blockchain technology spawned a new cryptocurrency: Bitcoin cash

REUTERS

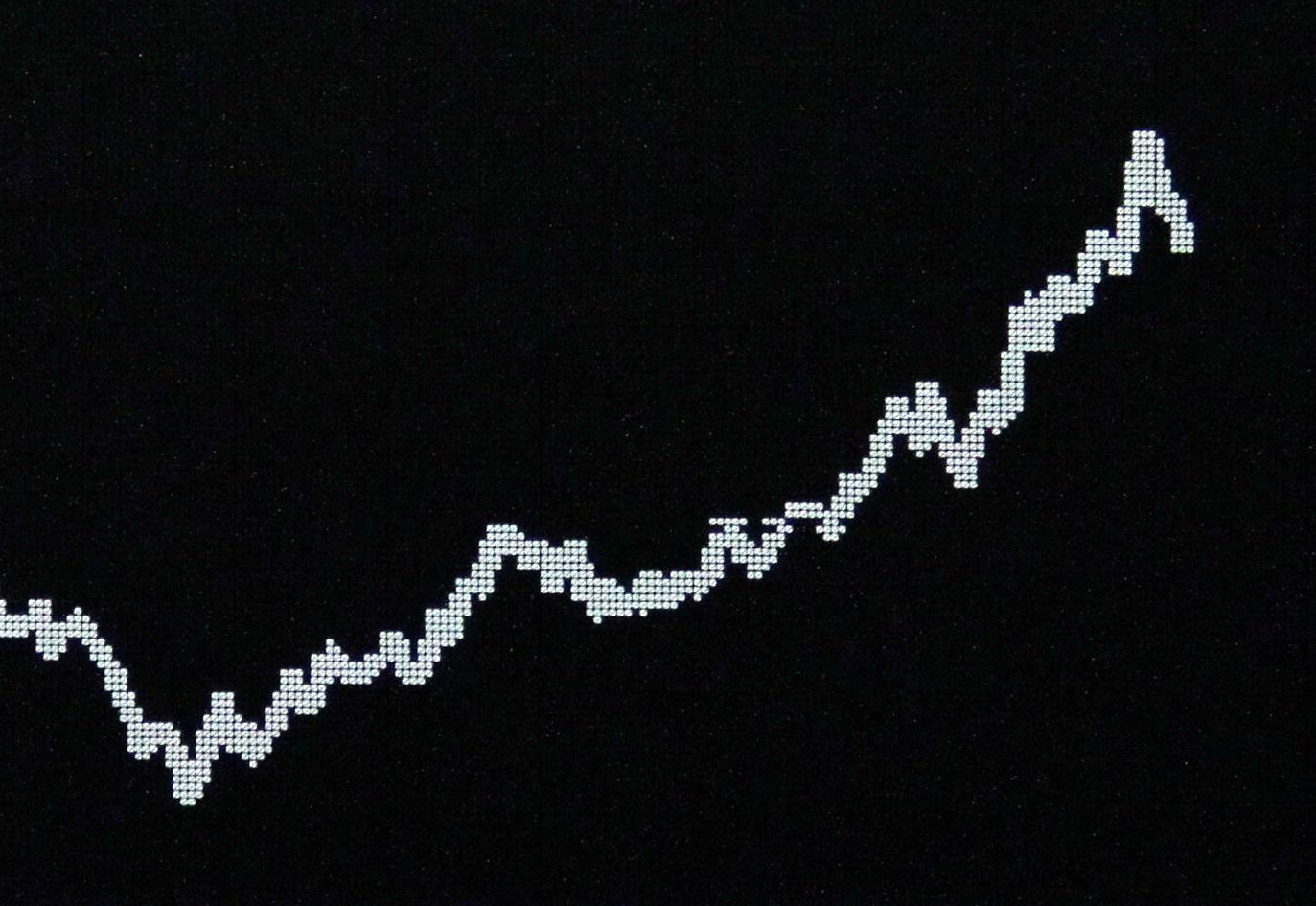

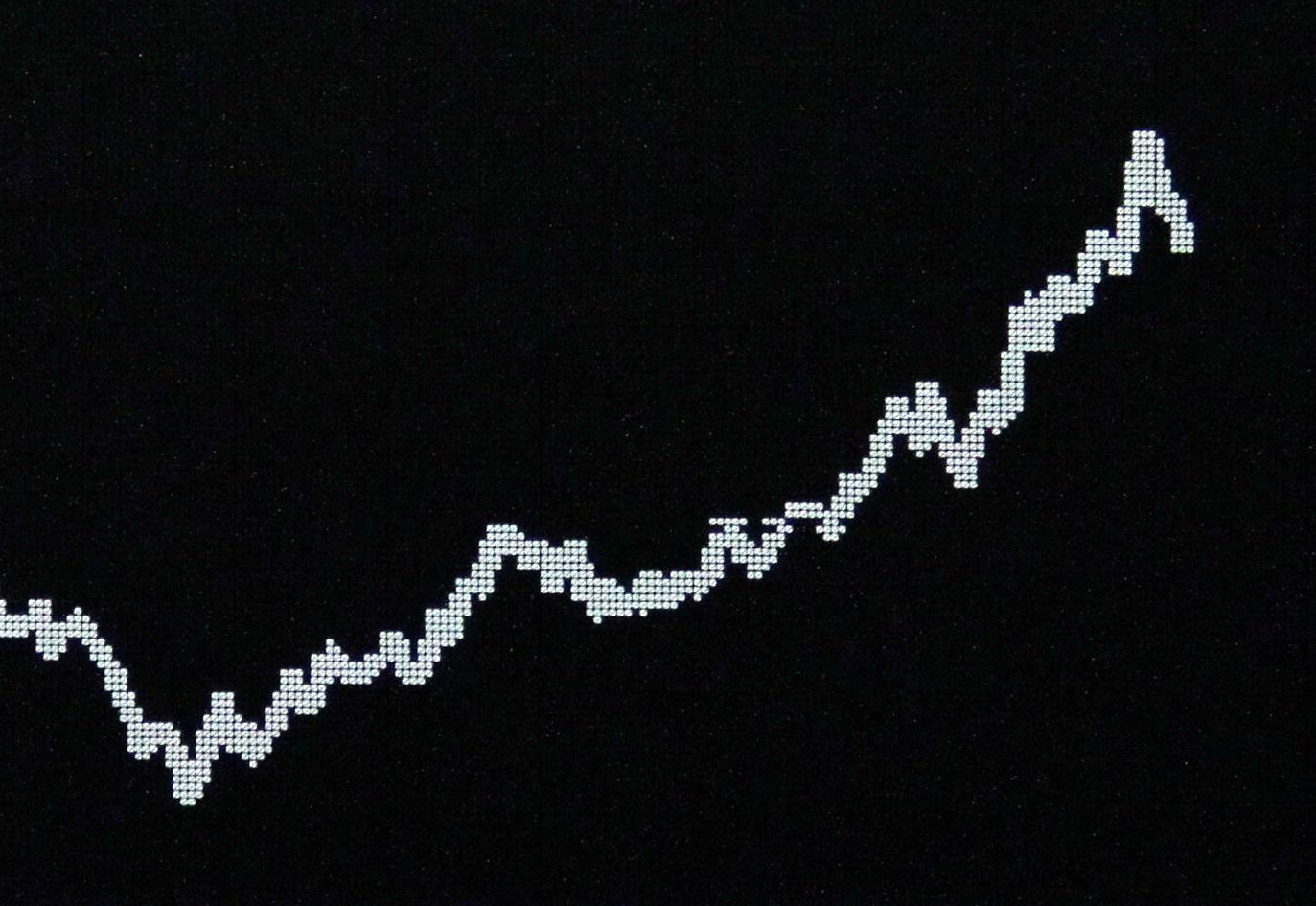

8/8 Bitcoin’s price sky rockets

Towards the end of 2017, the price of bitcoin surged to almost $20,000. This represented a 1,300 per cent increase from its price at the start of the year

Reuters

1/8 Satoshi Nakamoto creates the first bitcoin block in 2009

On 3 January, 2009, the genesis block of bitcoin appeared. It came less than a year after the pseudonymous creator Satoshi Nakamoto detailed the cryptocurrency in a paper titled ‘Bitcoin: A peer-to-Peer Electronic Cash System’

Reuters

2/8 Bitcoin is used as a currency for the first time

On 22 May, 2010, the first ever real-world bitcoin transaction took place. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $90 million at today’s prices

Lazlo Hanyecz

3/8 Silk Road opens for business

Bitcoin soon gained notoriety for its use on the dark web. The Silk Road marketplace, established in 2011, was the first of hundreds of sites to offer illegal drugs and services in exchange for bitcoin

4/8 The first bitcoin ATM appears

On 29 October, 2013, the first ever bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins for cash

REUTERS/Dimitris Michalakis

5/8 The fall of MtGox

The world’s biggest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing almost 750,000 of its customers bitcoins. At the time, this was around 7 per cent of all bitcoins and the market inevitably crashed

Getty Images

6/8 Would the real Satoshi Nakamoto please stand up

In 2015, Australian police raided the home of Craig Wright after the entrepreneur claimed he was Satoshi Nakamoto. He later rescinded the claim

Getty Images

7/8 Bitcoin’s big split

On 1 August, 2017, an unresolvable dispute within the bitcoin community saw the network split. The fork of bitcoin’s underlying blockchain technology spawned a new cryptocurrency: Bitcoin cash

REUTERS

8/8 Bitcoin’s price sky rockets

Towards the end of 2017, the price of bitcoin surged to almost $20,000. This represented a 1,300 per cent increase from its price at the start of the year

Reuters

Figures within the cryptocurrency industry welcomed the news, claiming it indicated regulators are at last recognising the potential benefits of digital currencies.

“When the first national central bank issues a CBDC, this will be a major milestone in monetary history and a turning point for the global financial system,” Andy Bryant, co-head of popular cryptocurrency exchange BitFlyer, told The Independent.

“However, at this stage, there is still a lot up for discussion. The particular design of each new CBDC — for instance, whether or not it bears interest — will have profound implications on its effectiveness as a monetary policy instrument.”

Marcus Swanepoel, CEO of London-based cryptocurrency firm Luno, described it as “very positive” but warned it would be a slow process.

“They understand a shift to digital currencies won’t happen overnight. However, it is a part of a generational change being driven by people who have grown up with technology and see the world in a different way,” he said.

“Over thousands of years, money has always evolved and most central banks would agree that the current international monetary system is now out of date.”

Original Source