Here’s what it’s like to dig tunnels at Elon Musk’s Boring Company

There are longstanding rivalries in the world of startups: growth versus discipline—innovation versus safety.

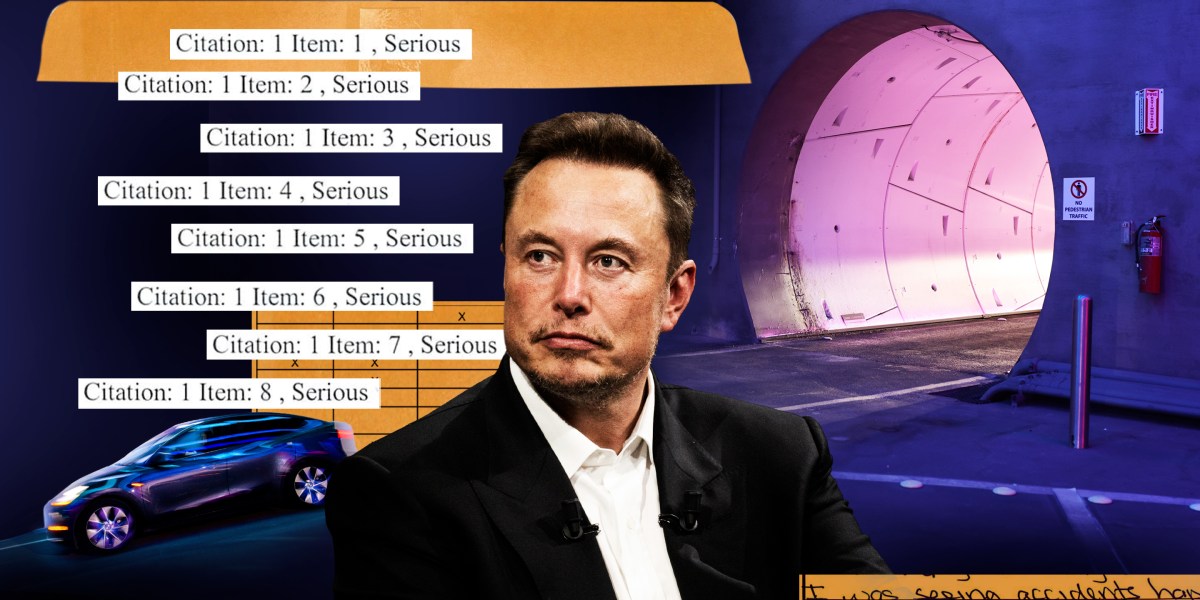

There may be few places where this tension is playing out so plainly as it is at Elon Musk’s Boring Company, the tunnel construction startup backed by Sequoia Capital and Vy Capital that is valued at more than $5.6 billion. Yesterday I published an investigation for Fortune, where I wrote about the dozens of injuries and safety complaints that have stacked up as Boring digs a tunnel system below Las Vegas.

I spent several months talking to the workers on the ground who have been tasked with turning Musk’s ambitious underground transit system vision into reality. Boring’s former safety manager, Wayne Merideth, described the working conditions as “almost unbearable.” Thousands of pages from an OSHA investigation from this summer showed workers suffering from heat exhaustion, knee or head contusions, or an elbow or hand being crushed. Former Boring employees described getting chemical burns as they waded or walked through a cement mixture that pooled with water in the base of the tunnels. OSHA ultimately issued Boring eight citations, finding some of its working conditions to be potentially fatal to employees and that Boring didn’t provide its employees with the proper safety equipment, training, and washing stations to protect themselves. (Boring ignored my requests for comment, though it vehemently denied OSHA’s findings in communications with the agency and is contesting them. Sequoia declined to comment, and other investors didn’t respond.)

Here’s what one employee documented in an emailed complaint to Merideth:

“I feel that the company as a whole has been very fortunate these past few months that there hasn’t been a fatality,” the employee from the Bastrop, Texas, worksite wrote at 1:53 a.m. in the email, which was seen by Fortune. “We have consistently flirted with death.”

The employee told Merideth in the email that, just recently, six of 12 passive articulation cylinders—the parts of the machine that would help Boring’s tunneling machine turn as it digs through the earth—failed while he was inside it, meaning that it “could have split with me inside it.” No one had warned him, he said. The employee wrote about a lack of accountability, and that he had “lost all confidence” in the company’s management to keep him safe.

“I have watched my friends get injured due to the fast pace we’ve been running,” he wrote. “I refuse to be the first fatality in this company’s history. No tunnel is worth a single person’s life.”

Long hours and weekends, high expectations, and rigid deadlines are hallmarks of Elon Musk’s companies: Tesla, SpaceX, and X, formerly Twitter. And construction is inherently one of the most dangerous industries in America.

But in the case of Boring, run by president Steve Davis, pressure to meet aggressive goals led to a disregard for the safety of workers who were testing and building the tunnels underground and controlling dangerous equipment, according to findings from Fortune. All of this raises an important question: Innovation at what cost?

You can read the full story here.

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

– Glean, a Palo Alto, Calif.-based AI-powered work assistant, raised $200 million in Series D funding. Kleiner Perkins and Lightspeed Venture Partners led the round and were joined by Sequoia Capital, Coatue, ICONIQ Growth, IVP, Capital One Ventures, and others.

– Oishii, a Jersey City, N.J.-based vertical strawberry and tomato farm, raised $134 million in Series B funding. NTT led the round and was joined by Bloom8, McWin Capital Partners, Mizuho Bank, and others.

– Exodigo, a Tel Aviv, Israel and Palo Alto, Calif.-based developer of AI-powered underground mapping technology, raised $105 million in Series A funding. Greenfield Partners and Zeev Ventures led the round and were joined by existing investors SquarePeg, 10D VC, JIBE, and National Grid Partners.

– Unseenlabs, a Rennes, France-based developer of radio frequency data designed for maritime surveillance, raised €85 million ($92.2 million) in Series C funding. Supernova Invest, ISALT, and UNEXO led the round and was joined by 360 Capital, OMNES, Bpifrance, and others.

– HALO, a Dublin, Ireland-based provider of subscription-based bodycam and digital asset management services, raised $20 million in Series A funding from Volition Capital.

– Tracksuit, an Auckland, New Zealand-based brand tracking platform for marketing teams, raised $13.5 million in Series A funding. Altos Ventures and Footwork led the round and were joined by existing investors Blackbird, Icehouse Ventures, Ascential, Shasta Ventures, and others.

– Parspec, a San Mateo, Calif.-based AI-powered software platform designed to streamline the selection and sale of construction products, raised $11.5 million in seed funding. Innovation Endeavors led the round and was joined by Building Ventures, Heartland Ventures, and Hometeam Ventures.

– Validation Cloud, a Zug, Switzerland-based Web3 data streaming and infrastructure company, raised $5.8 million in funding. Cadenza Ventures led the round and was joined by Blockchain Founders Fund, Bloccelerate, Blockwall, Side Door Ventures, Metamatic, GS Futures, and AP Capital.

– Axiom Cloud, a San Jose, Calif.-based developer of refrigeration management software designed to reduce energy usage and costs, raised $5 million in funding from Toshiba Tec and Windsail Capital Group.

– Choice, a Prague, Czech Republic-based subscription platform where restaurants can create websites, menus with QR codes, table reservations, and other tools, raised $2.5 million in funding. J&T Ventures led the round and was joined by Reflex Capital and Presto Ventures.

– BuildBear Labs, a Singapore-based testing and validation platform for developers creating secure decentralized applications, raised $1.9 million in funding. Superscrypt, Tribe Capital, and 1kx led the round and were joined by Iterative, Plug-N-Play, and angel investors.

– KLIQ, a Miami, Fla.-based no-code business infrastructure platform designed for creators to build their own branded apps, raised $1.5 million in pre-seed funding. Serena Ventures led the round and was joined by angel investors.

– Roga, a Toronto, Canada and Los Angeles, Calif.-based developer of a wearable device designed to relieve stress and mental symptoms, raised $1 million in pre-seed funding from Exceptional Ventures, Minded Ventures, the Angelist Fund, and others.

PRIVATE EQUITY

– Octopus Deploy, backed by Insight Partners, acquired Codefresh, a Mountain View, Calif.-based DevOps management platform, for $28 million.

– Bridgenext, backed by Kelso & Company, acquired Folcode, a San Juan, Argentina-based digital engineering services company. Financial terms were not disclosed.

– CST Industries, a portfolio company of Solace Capital, acquired Ostsee Tank Solutions GmbH, a Stralsund, Germany-based manufacturer of storage tank parts and covers. Financial terms were not disclosed.

– Hunter Point Capital acquired a minority stake in Pretium, a New York City-based specialized investment firm. Financial terms were not disclosed.

– Nordic Capital agreed to acquire a majority stake in ActiveViam, a New York City-based provider of risk analytics, regulatory compliance software, and other solutions for financial institutions.

OTHER

– Cox Enterprises acquired OpenGov, a San Francisco-based provider of cloud software for public sector agencies and governments, for $1.8 billion.

– Veradigm (NASDAQ: MDRX) agreed to acquire ScienceIO, a New York City-based AI tool designed to turn health care data into insights , for $140 million in cash.

FUNDS + FUNDS OF FUNDS

– EQT, a Stockholm, Sweden-based private equity firm, raised €22 billion ($23.9 billion) for its tenth fund focused on companies in the health care, technology, and tech-enabled services sectors.

– Renovus Capital Partners, a Wayne, Pa.-based private equity firm, raised $325 million for their first continuation fund to recapitalize four of their existing portfolio companies.

– Zacua Ventures, a San Francisco-based venture capital fund, raised $56 million for its first fund focused on construction tech companies.

PEOPLE

– Carlyle (NASDAQ: CG), a Washington, D.C.-based private equity firm, hired Jeff Currie as chief strategy officer of energy pathways. Formerly, he was with Goldman Sachs.

– Rotunda Capital Partners, a Washington, D.C. and Chicago, Ill.-based private equity firm, promoted Ryan Aprill to managing director and Alex Gebert to vice president.

Original Source