Bitcoin rises towards record high; SEC ‘investigating if OpenAI investors were misled’ – business live

Newsflash: UK lenders approved more mortgages in January, as the housing market picked up.

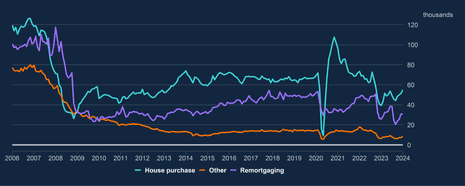

Net mortgage approvals for house purchases rose from 51,500 in December to 55,200 in January, new data from the Bank of England shows.

This is the highest number of new mortgage approvals since October 2022, when the market had been rocked by Kwasi Kwarteng’s disastrous mini-budget which led to a jump in mortgage rates.

But it’s still well below the levels seen after the first Covid-19 lockdowns:

Net approvals for remortgaging remained stable at 30,900 in January.

The BoE also reports that the ‘effective’ interest rate on new mortgages fell by 9 basis points, to 5.19% in January, as borrowers benefited from cuts to mortgage rates, following the fall in inflation last year.

Filters BETA

Video games developer Electronic Arts (EA) has announced it is cutting 5% of its staff, as part of a cost-cutting and restructuring programme.

This means around 670 employees will lose their jobs.

In an email to staff announcing the cuts, EA chief executive Andrew Wilson said the company is moving away from creating new games, and will instead focus on its “owned IP, sports, and massive online communities”.

Wilson said the company will stop work on some in-development games and cancel other planned titles “that we do not believe will be successful in our changing industry”.

Instead, it will “double down” on its existing titles – which includes EAFC, the football game series formerly known as Fifa.

He said the company is “leading through an accelerating industry transformation where player needs and motivations have changed significantly”.

Over in Ireland, inflation has dropped to its lowest level in two and a half years.

Prices in Ireland estimated to have risen by 2.2% in the 12 months to February 2024, on an EU-harmonised basis.

That brings annual inflation in the Republic down to near the European Central Bank’s 2% target.

However, on a monthly basis, consumer prices are estimated to have risen by 0.9% in February alone.

Energy prices are estimated to have risen by 0.5% in the month, but fell by 6.3% over the last year.

Food prices are estimated to have increased by 0.5% in the last month, and risen by 3.7% in the last 12 months.

Annual core inflation in Ireland, which strips out energy and food, dropped to 3.1% from 3.8% in January.

Clare Lombardelli’s move to the Bank of England will mean that its monetary policy committee will have a majority of women this summer – for (I think) the first time in its history.

She also won’t be the only former Treasury staffer on the MPC, as Reuters’ Andy Bruce points out:

Newsflash: economist Clare Lombardelli has been appointed as a deputy governor of the Bank of England.

Lombardelli is currently chief economist at the Organization for Economic Cooperation and Development, having joined the OECD last year after a long stint working at the UK Treasury.

She will succeed Ben Broadbent, currently the Deputy Governor for Monetary Policy at the Bank of England, on 1st July, on a five-year term.

Lombardelli’s departure to the OECD early last year had been seen as a blow to the UK government, as she had 20 years’ experience in economic analysis culminating in serving as the Treasury’s chief economic adviser.

She started her career at the Bank of England and has also worked in 10 Downing Street as the Private Secretary for Economic Affairs to prime minister David Cameron (see her LinkedIn profile).

The Bank says Lombardelli will oversee the formulation and implementation of UK monetary policy and will lead the Bank’s research, data and analytics.

She will also lead the response to the current review the Bank’s forecasting functions, being carried out by former top US central banker Ben Bernanke, after the BoE failed to predict the recent spike in inflation.

Jeremy Hunt, Chancellor of the Exchequer, says:

“I am delighted to appoint Clare Lombardelli as the next Deputy Governor for Monetary Policy at the Bank of England. Clare brings significant experience to the role tackling financial and economic issues both domestically and internationally.”

Andrew Bailey, Governor of the Bank of England, said:

“I’m really pleased to welcome Clare Lombardelli back to the Bank as Deputy Governor for Monetary Policy.

Clare’s impressive career means she brings a huge amount of relevant experience and expertise to the Monetary Policy Committee, and the Bank more broadly, at a time of great importance for the UK economy.

Here’s some early reaction to UK mortgage approvals hitting their highest level since October 2022 last month.

Ashley Webb, UK economist at Capital Economics, points out that mortgage approvals were the highest since the panicky weeks after the mini-budget of 2022, which drove up borrowing costs:

January’s money and credit figures suggest the drag on consumer spending and the housing market from higher interest rates is easing, which suggests an economic recovery, at least in some sectors, has already begun.

The jump in mortgage approvals for house purchase, from 51,506 in December to 55,227 in January (consensus forecast 52,000), took them to the highest level since October 2022, before the spike in mortgage rates following the “mini” budget caused lending to slump.

Tom Bill, head of UK Residential Research at estate agent Knight Frank, says the market is adjusting to the prospect of lower interest rates:

“Buyers and sellers have realised the interest rate landscape has changed meaningfully in the last four months. Rate cut expectations have softened since Christmas but mortgage approvals and transaction numbers are heading in the right direction after a year of stubborn inflation and rising rates in 2023.

Both are still a fifth below their five-year average but demand will get stronger as inflation comes under control, which should underpin a 3% UK house price increase in 2024.”

Aaron Milburn, UK managing director at credit intelligence provider Pepper Advantage, says signals that interest rates may have reached their peak have lifted mortgage approvals in January.

The Bank of England has clearly set a path to lower rates as inflation shows signs of steady decline, a move that has breathed new life into the mortgage market as banks pre-emptively lower their fixed-term rates to entice buyers. These moves appear to be paying off after a period of relative stagnation as banks tap into strong mortgage demand.

“While the increase in mortgage approvals is a positive sign, other corners of the market remain under significant pressure. Mortgage arrears remain high as the cost-of-living crisis persists – while economically mobile, cash-rich buyers feel that they are able to take on expensive mortgages, we need to remain cognisant that this is not the full picture in a polarised market. For home buyers and economists, all eyes will be on the Bank of England’s next rates decision in March.”

The jump in UK mortgage approvals in January (see 9.38am) is the latest sign that activity in the housing market is rallying.

Overnight, property website Zoopla has predicted that home sales will rise by 10% this year, following a pick-up in sales and demand in early 2024.

Zoopla reports that all measures of activity were higher this month than in February 2023, with agreed sales up by 15% and buyer demand up by 11%.

As a result, the market is on track to reach 1.1m transactions across the year, up from 1m in 2023, it said.

Across the UK prices were down by 0.5% year-on-year, although this masked regional variations. In Scotland, Northern Ireland, Wales, the Midlands and the north of England prices increased, but across the south of England they fell.

Newsflash: UK lenders approved more mortgages in January, as the housing market picked up.

Net mortgage approvals for house purchases rose from 51,500 in December to 55,200 in January, new data from the Bank of England shows.

This is the highest number of new mortgage approvals since October 2022, when the market had been rocked by Kwasi Kwarteng’s disastrous mini-budget which led to a jump in mortgage rates.

But it’s still well below the levels seen after the first Covid-19 lockdowns:

Net approvals for remortgaging remained stable at 30,900 in January.

The BoE also reports that the ‘effective’ interest rate on new mortgages fell by 9 basis points, to 5.19% in January, as borrowers benefited from cuts to mortgage rates, following the fall in inflation last year.

On the economic front, Switzerland’s economy grew faster than expected at the end of last year.

Swiss GDP rose by 0.3% in the October-December quarter, beating the 0.1% growth which analysts expected.

The Swiss Federal Statistical Office says the services sector was one of the main growth drivers, as tourism recovered following the COVID-19 pandemic.

Shares in UK energy generator Drax have rocketed to the top of the FTSE 250 leaderboard of medium-sized companies this morning, after it reported a jump in profits.

Drax, which runs a biomass power plant in North Yorkshire, has posted a pre-tax profit of £796m for 2023, up from £78m in 2022. Shares are up around 6%.

Adjusted earnings rose 66% to £1.2bn, as Drax profited from the jump in power prices last year.

Will Gardiner, CEO of Drax Group, says:

“Drax performed strongly in 2023 and we remained the single largest provider of renewable power by output in the UK.

We have created a business which plays an essential role in supporting energy security, providing dispatchable, renewable power for millions of homes and businesses, particularly during periods of peak demand when there is low wind and solar power.

Drax’s results also show it paid £205m to the UK government under its windfall tax, the Electricity Generator Levy, which was extended to low-carbon energy producers in late 2022.

Newsflash: There’s takeover battle drama in the City this morning!

American logistics firm GXO has announced a cash offer for UK haulage firm Wincanton, worth 605p per share.

GXO are trying to gate-crash an agreed bid from France’s CEVA Logistics, worth 480p per share for Wincanton.

GXO say their offer values Wincanton at £762m, higher than CEVA’s offer of around £600m.

Wincanton employs 20,000 people across Britain, shuttling goods around the country for customers such as Asda, Sainsbury’s and Waitrose.

Wincanton’s board had been supporting CEVA’s bid.

But GXO says today it expects that the Wincanton Board will recommend its offer “in due course”.

Shares in Wincanton have jumped 17% to 600p.

In the City… shares in Ocado have jumped almost 7% in early trading after the grocery technology firm narrowed its losses.

Ocado has reported it made a pre-tax loss of £394m in 2023, up from a £500m loss in 2022.

Revenues rose almost 10% to £2.8bn, led by its Technology Solutions arm which sells robotic grocery warehouse kit worldwide.

Tim Steiner, CEO of Ocado Group, says the company made “good progress” last year, adding:

Our technology is transforming the way people shop for food as we help some of the world’s best and most innovative retailers set the bar for excellence in grocery ecommerce worldwide.

We opened three new state-of-the-art robotic CFCs; in Chiba city (near Tokyo) in Japan, Calgary in Canada, and Luton here in the UK and increased the amount of installed capacity for our clients by a quarter. We now have installed capacity at our retail partners for gross annual grocery sales of over £8bn.

On an EBITDA basis (ignoring interest, tax, and the depreciation and amortisation of assets), Ocado made a profit of £54m, up from a £74m EBITDA loss in 2022.

With the UK budget less than a week away, chancellor Jeremy Hunt is reportedly considering scrapping Britain’s non-domiciled tax rules.

The non-dom status allows about 70,000 people to avoid paying tax on their overseas earnings.

Several newspapers report that Hunt has put abolishing non-doms on a list of options being held in reserve in case his fiscal position deteriorates.

Hunt is under serious pressure from backbench Conservative MPs to announce tax cuts next week; his problem is that his fiscal firepower has been shrinking. That’s because the City has cut its expectations for interest rate cuts in the future, which means Hunt’s headroom to splash the cash and still see debt falling in five years has fallen.

Scrapping non-dom status would be a u-turn for Hunt; he has previously argued that it’s in the UK’s interest for the super-rich to stay and spent their money here.

It would also potentially mess up the Labour Party’s plans; it hopes to raise £2bn by scrapping non-dom tax breaks to fund the NHS and primary school breakfast clubs.

Other crypto-currencies are also rallying, as bitcoin’s rally lifts interest in the altcoin market.

Ether, the crypto-curency for the Ethereum blockchain platform, is up 4% today at $3,464.

Ether is also up 50% so far this year (matching bitcoin’s rally), and has more than doubled over the last six months.

Chris Weston of brokerage Pepperstone says there is “an increasing belief that an Ethereum cash ETF is coming”, and that many in the crypto world see SEC approval as “a matter of when not if”.

FOMO, or fear of missing out, is another factor driving bitcoin higher, says Ipek Ozkardeskaya, senior analyst at Swissquote.

Ozkardeskaya explains:

The coin’s price is rising exponentially since the week started; a unit of Bitcoin traded at $64’000 per coin yesterday. That’s around $5K shy of the ATH recorded back in 2021, and the strength of the rally makes us think that there is rising FOMO aiming the $100K mark.

Of course, I am not saying that Bitcoin will rally straight to that level, but enthusiasm will clearly be back if Bitcoin successfully clears the $69K offers. From a fundamental perspective, the price surge makes sense. Supply is limited, demand is surging, hodlers aren’t willing to sell and the arrival of Bitcoin ETFs made the asset class more investable for big players.

And indeed, spot Bitcoin ETFs have amassed $6bn since their inception, and BlackRock’s ETF saw a whopping $520 million inflows in a single day. It was apparently the second biggest inflow into a US ETF, all asset classes included.

Ozkardeskaya cautions, though, that the price moves in cryptocurrencies are driven by a fair amount of speculation and so there could be big fluctuations, adding:

Some already call for a 20% downside correction after the rally is done.

US regulators are reportedly probing artificial intelligence pioneer OpenAI, the organisation behind the ChatGPT chatbot, following its boardroom turmoil three months ago.

The Wall Street Journal reports this morning that the Securities and Exchange Commission is “scrutinizing internal communications” by OpenAI Chief Executive Sam Altman as part of an investigation into whether the company’s investors were misled.

The WSJ says:

The regulator, whose probe hasn’t previously been reported, has been seeking internal records from current and former OpenAI officials and directors, and sent a subpoena to OpenAI in December, according to people familiar with the matter. That followed the OpenAI board’s decision in November to fire Altman as CEO and oust him from the board. At the time, directors said Altman hadn’t been “consistently candid in his communications,” but didn’t elaborate.

Altman returned as CEO less than two weeks later as part of a deal that also entailed a reconstituted board, which he hasn’t joined.

SEC officials based in New York are conducting the investigation and have asked that some senior OpenAI officials preserve internal documents.

Altman was dramatically dismissed by OpenAI’s board in November, and then sensationally rehired a week later after a staff revolt:

News of the SEC’s move comes as Altman holds talks with investors to raise trillions of dollars to reshape the global semiconductor industry.

The WSJ points out that the SEC often closes investigations without making formal accusations of wrongdoing; it enforces laws that forbid people from misleading investors.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The world’s largest cryptocurrency is heading towards its alltime high, as crypto mania returns to the markets.

Bitcoin is continuing its wild ride this morning, up another 4% today at over $63,000.

This takes bitcoin’s gains so far this year to 50% (and it’s still only February, just!).

This puts bitcoin in sight of its alltime high of almost $69,000, set in November 2021, before it fell back during 2022.

Bitcoin’s gains in recent weeks have been driven by the launch of new Bitcoin ETFs, approved by US regulators last month, which make it easier to trade bitcoin.

There have been large client inflows into the ETFs launched in recent weeks by investment groups such as BlackRock and Fidelity.

Those ETFs are buying up bitcoins – at a rate faster than they are being created, or that long-time holders are willing to sell. This is pushing up the price.

Another factor is that a bitcoin halving event takes place in April. This will cut the reward for mining bitcoins, which is designed to slow the supply of new coins into the market.

One bitcoin bull, MicroStrategy, has also added to the rally by revealing this week it has bought another 3,000 bitcoin.

Trading is jittery, though – yesterday bitcoin approached the $64,000 mark, before dropping back and finishing above $60,000.

Tony Sycamore, market analyst at IG, says the market is setting up to “test and likely break” the November 2021 all time $69,000 high.

Sycamore explains:

Bitcoin’s resurrection from the crypto winter is comparable to that of the mythical Phoenix of Greek legend. But here we have a new legend taking shape, and whether it lasts for 500 years like the Phoenix, as Bitcoins proponents might hope, remains to be seen.

Bitcoin’s gains in recent weeks have been driven by record client inflows into the newly minted Bitcoin ETF’s. Amongst other reasons are anticipation of the Bitcoin halving event in April, concerns over a partial US government shutdown, and MicroStrategy’s Michael Naylor adding 3000 Bitcoins to his already considerable holdings.

This tweet from last night shows how volumes into bitcoin ETFs have been rising:

Also coming up today

Growth data from India, Canada and Switzerland will give us more insight into how the world economy fared in the last quarter of last year.

Global investors are also poised for the Federal Reserve’s favoured inflation measure to be released today. The US PCE index, which tracks changes in the prices of goods and services purchased by consumers in the United States, is expected to have dipped – core PCE is forecast to dip from 2.9% to 2.8%.

While in the UK, the Bank of England’s Money and Credit report will show how many mortgages were approved last month.

The agenda

-

8am GMT: Switzerland’s Q4 2023 GDP report

-

8.55am GMT: Germany’s unemployment report for February

-

9.30am GMT: Bank of England data on mortgage approvals and consumer credit

-

Noon: India’s Q4 2023 GDP report

-

1pm GMT: Germany’s inflation report for February

-

1.30pm GMT: US weekly jobless report

-

1.30pm GMT: US PCE measure of prices

Original Source